A billion dollars is a massive amount of money (billionaires). Today, many people in the world are billionaires. They own more money than they could ever spend. At the same time, many people struggle with poverty. This huge difference in wealth has called extreme inequality. Many people ask, “What if we got rid of billionaires?” This idea means using a law or a huge tax to remove extreme wealth. It means redistributing that money to the public. This is a very radical idea. It would completely change the global economy. We will look at the possible benefits of this change. We will also look at the massive problems it would cause.

The Mechanism: How Would It Work? billionaires

“Abolishing” billionaires does not mean sending them away. It means setting a maximum limit on how much money one person can own. For example, a law might say no one can have more than $999 million. Any money over that limit would taken by the government. This is a form of extreme wealth tax.

The Wealth Tax: This tax would not be on income (the money you earn from a job). It would be on assets (the things you own). Assets include stocks, expensive homes, and companies. The tax would put on the value of everything a person owns over the limit. This massive tax would bring huge amounts of money into the government.

The Good Idea: Massive Public Funding billionaires

The biggest reason to support this idea is the potential for public good. If the money from all the billionaires has collected, it would be a staggering sum.

Funding Social Programs: This money could used to solve many big social problems. Governments could use the funds for:

- Ending Poverty: Providing enough money for basic needs for everyone.

- Education: Making sure all schools are excellent and that college is free for everyone.

- Healthcare: Making sure everyone has high-quality medical care without worrying about cost.

This massive redistribution of wealth could quickly lower poverty and improve the lives of billions of people. This is the main argument for abolishing billionaires.

Hiding and Moving the Money billionaires

The first major problem is practical. Wealthy people are very good at protecting their money.

Capital Flight: If a country tried to abolish billionaires, those billionaires would move immediately. They would move their money, their stocks, and their businesses to a country that does not have that law. This is called “capital flight.”

Losing the Tax Base: The country would lose the tax money it was trying to gain. The money would just move to Switzerland, Singapore, or other countries. The country trying to abolish billionaires would end up with less money, not more. For this idea to work, almost every country in the world would have to agree to it at the same time. This is almost impossible.

The Hit to Innovation

Billionaires often do not keep their money sitting in a bank. They use it to fund risky ideas. This is called venture capital.

Funding New Companies: Billionaires invest heavily in new technology companies. They invest in companies that are trying to cure diseases or build new energy sources. These new ideas are very risky. They might fail. But if they succeed, they change the world. This investment is key to innovation.

The Loss of Risk-Taking: If you remove the possibility of becoming extremely wealthy, the desire to take huge risks disappears. Why work 20 hours a day for 20 years to build a huge company if you know the government will take the money away? Without that high reward, the innovation engine would slow down greatly. New companies would not get the funding they need. Progress would stop.

The Value of Assets billionaires

Billionaires’ wealth is often not cash. It is tied up in the value of their companies.

Stocks, Not Cash: For example, the richest man’s wealth is mainly in the stock of his company. If the government tries to take that money, it means the government has to sell the company’s stock.

Market Crash: If the government sells billions of dollars of one company’s stock very quickly, the stock price would crash. This would hurt all the people who have savings invested in that same stock. It would hurt the middle class who have pensions or retirement funds. The value of the company itself would fall. This process would damage the entire financial market.

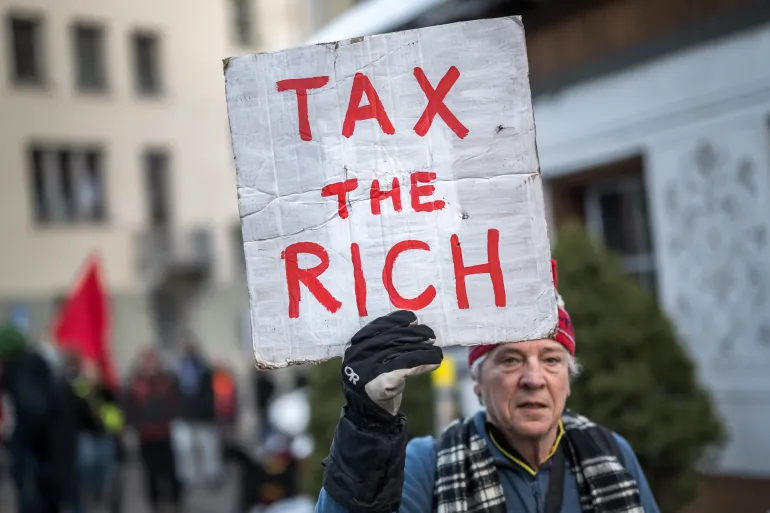

The Alternative: Fixing the Tax System

Most economists do not support abolishing billionaires. They support fixing the problems in the current tax system.

Fairer Taxes: The real problem is that billionaires often do not pay a fair share of income tax. They often find legal ways to avoid paying the tax. They take loans instead of selling their assets.

Progressive Reforms: A better solution is a strong, progressive tax system. Progressive means the richest people pay the highest rate. This includes:

- Higher Income Tax: Making sure high-income earners pay a very high tax rate.

- Taxing Assets: Taxing assets when they are sold, not just when a person dies.

These changes would raise huge amounts of money for public programs without creating the chaos of abolishing billionaires. It is a way to gain the benefits of redistribution without destroying innovation.

Idea of Abolishing Billionaires

The idea of abolishing billionaires is powerful. It sounds like a fast solution to end extreme inequality. It would give governments massive funds to help the poor. However, the practical problems are too great. Abolishing extreme wealth would cause massive capital flight. It would likely slow down innovation. It would crash the stock market. The internet, new medicines, and new energy companies are often funded by these large risks. The better solution is to fix the tax system. We need to make sure the richest people pay a fair and proper share of tax. This will allow the country to fund social programs without destroying the very engine of economic progress.

Read More Articles Click Here. Read Previous Article Click Here. Inspired by Al-Jazeera.

Leave a Reply